Here are our favorite debit card card management control features:

You can’t seem to find your debit card, but you’re pretty sure it’s somewhere in your house…or your car. Now you can instantly turn your debit card off from your mobile app, preventing it from being used by someone else. Assuming your debit card was not left anyplace public—and it’s safely back in your wallet—turn it back on and it’s immediately ready for use. Security Tip: In the event your card was stolen or out of your possession in a public place for any period of time, turn your debit card off right away and keep it off. Someone could have copied your card number while it was out of your possession. Once you turn your card off, the bank won’t allow purchases or withdrawals to occur. Be sure to call your bank to cancel your debit card and request a new one or visit your local branch and walk away with a new debit card instantly.

Debit card controls also allow you to establish restrictions on the geographic areas in which your card can be used. If you know you won’t be travelling out of your local area in the foreseeable future, you can block international transactions and/or those outside a specific area (just select an address and set the active radius). Card transactions outside this area will be declined, which can reduce the potential for debit card fraud. If you decide to venture out of your designated area, just pull out your smartphone and change your settings. Pro Tip: For these kinds of restrictions, you’ll need to be mindful of recurring debits to the card such as Netflix® and iTunes®, which are not likely local.

Debit card controls also offer you more control over how you—and your family—spend money. Set transactions limits and ATM withdrawals limits. Anything over the dollar amount you set, will be blocked.

Pro Tip: Parents can use debit card controls to create parameters for how much your teen or college student can spend, where they can use their card, and with which types of merchants.4. Choose Merchant Categories

Now you can block transactions at certain types of merchants. For instance you can enable groceries and gas stations for everyday purchases, but disable entertainment and travel until needed.

Still not sure and concerned about disabling something you may need? Don’t worry—you can change your settings at any time and it will take effect instantly. For more confidence about debit card controls and to see it in use, view these videos.

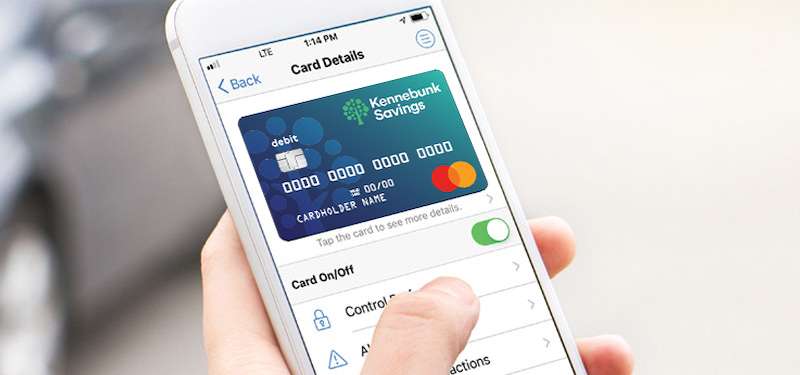

All these features are designed to give you more control, while also providing extra security. So, go ahead and manage your debit card control preferences from your mobile app. Don’t have the Kennebunk Savings mobile app yet? Download it from the iOS App Store® or Android Google Play.®

Apple Pay® and iTunes® are trademarks of Apple Inc.

Google Pay™ is a trademark of Google LLC.